Canal Hamamatsu | Top Page > Taxes > National Taxes > 【National Taxes】 How to Fill Out Final Income Tax Return (Page 2)

ここから本文です。

更新日:2023年1月25日

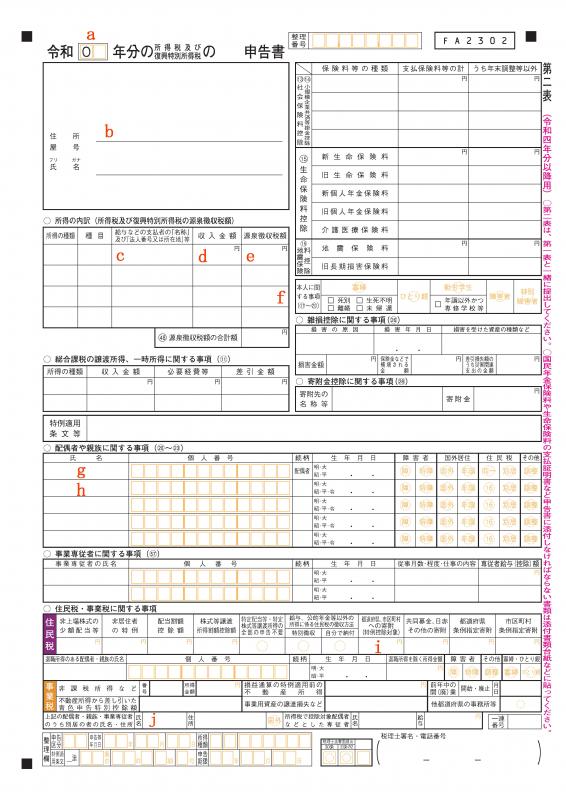

【National Taxes】 How to Fill Out Final Income Tax Return (Page 2)

| a | Year before Filing Tax Return | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| b | Current Address and Name | ||||||||||||||

| c | Company Name and Address | ||||||||||||||

| d | Amount you get paid from company in column C above (If you have more than one withholding statement in a year, write the amounts from all of them) | ||||||||||||||

| e | Withholding tax amount | ||||||||||||||

| f | You are a widow (widower), single parent, working student or a person with a disability | ||||||||||||||

| g | Fill in your spouse’s name, My Number, date of birth and circle the applicable items | ||||||||||||||

| h | Fill in the dependent’s name, My Number, date of birth and circle the applicable items

As per the Income Tax Act, up to 6 blood relatives of yours and up to 3 blood relatives of your spouse can be declared as dependents. The dependent’s income must not be over 480,000 yen |

||||||||||||||

| i | Amount donated to Furusato tax programme | ||||||||||||||

| j | If the dependents in (g) and (h) are living apart from you, please write that person’s name and address. *When that person lived abroad Please attach the following documents with your form. If you have submitted these documents to your company during the year-end adjustments, you are not required to submit them again. (If the documents are in a foreign language, you will need to translate them.) ・Bank remittance certificates (proof you sent money to your dependent at a bank) and documents from your credit card company that show your name as the sender and the names of the person who received the money you sent. * The documents needed to establish proof of relation (marriage certificate, birth certificate) differ by dependent type. Please see the table below for the required documents. (○ means marriage certificate, △ means birth certificate)

They also can’t be declared as your dependent if they are already someone else’s dependent. |

||||||||||||||

| Items required for Tax Return ・A document with your MyNumber on it. (i.e. MyNumber Card, etc.) ・Withholding statement (original) ・Residence Card ・Bank book (for tax refunds) * For any other enquiries, please enquire at a tax office (zeimusho). |

|||||||||||||||