Canal Hamamatsu | Top Page > Taxes > National Taxes > 【National Taxes】 How to Fill Out Final Income Tax Return (Page 1)

ここから本文です。

更新日:2023年1月25日

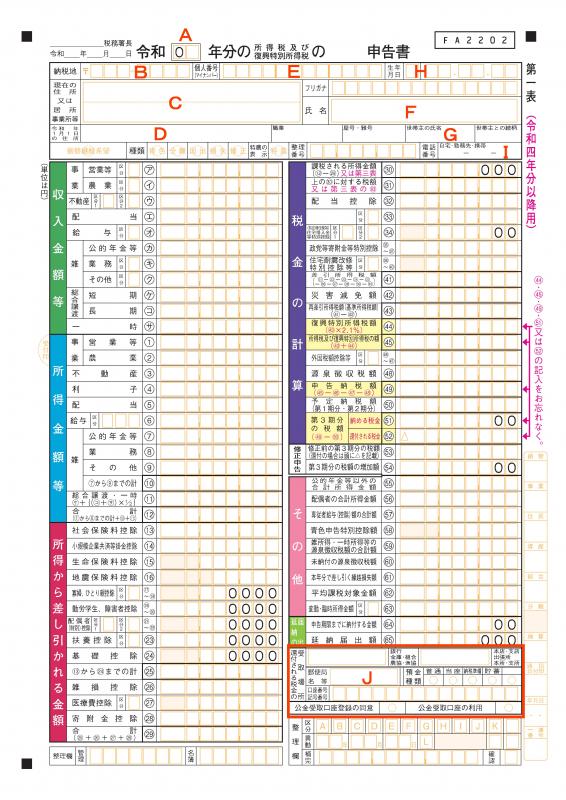

【National Taxes】 How to Fill Out Final Income Tax Return (Page 1)

| A | Year before Filing Tax Return |

|---|---|

| B | Postal code |

| C | Current address |

| D | Address on January 1 of the tax return year |

| E | My Number (Individual Number) |

| F | Name (same as on your Residence Card) |

| G | Name of Head of Household |

| H | Date of Birth →Write in the number for the era you were born in from below Meiji・・・1 Taisho・・・2 Showa・・・3 Heisei・・・4 Reiwa・・・5 |

| I | Telephone Number |

| Types of Income |

(1): Real estate income |

| Types of Deductions | (13): Social Insurance Premium Deduction (14): Small Enterprise Mutual Relief Premium Deduction (15): Life Insurance Premium Deduction (16): Earthquake Insurance Deduction (17)~(18): Widow (Widower)/Single Parent Deduction (19)~(20): Working Students and Disability Deduction (21)~(22): Spousal Deduction, Special Spousal Deduction (*When the income of the spouse is between 480,000 and 1,330,000 yen) (23): Dependent Deduction (24): Basic Deduction (25): (13)~(24) (26): Miscellaneous Loss Deduction (27): Medical Expense Deduction (28): Donation Deduction (29): Total of Income Deductions |

| Calculation of Tax | (30): Total taxable income: Subtract total income deductions (29) from total amount (12) (round down to the nearest 1000 yen) (31): Use the following methods to calculate tax If the income amount calculated in (30) is: (48) Withholding tax amount (51) Income tax will be paid when it is calculated and we get a correct amount (52) Income tax will be returned when it is calculated and we get the correct amount. * For any other enquiries, please enquire at a tax office (zeimusho). |